extended auto warranty insurance companies explained with a practical comparison guideShopping for post-warranty coverage often blends relief with doubt. Repairs are unpredictable; contracts feel dense. This guide compares how companies actually operate so you can weigh trade-offs with clear eyes. Company types at a glance- Direct providers: Sell and administer their own plans. Fewer handoffs; accountability is clearer.

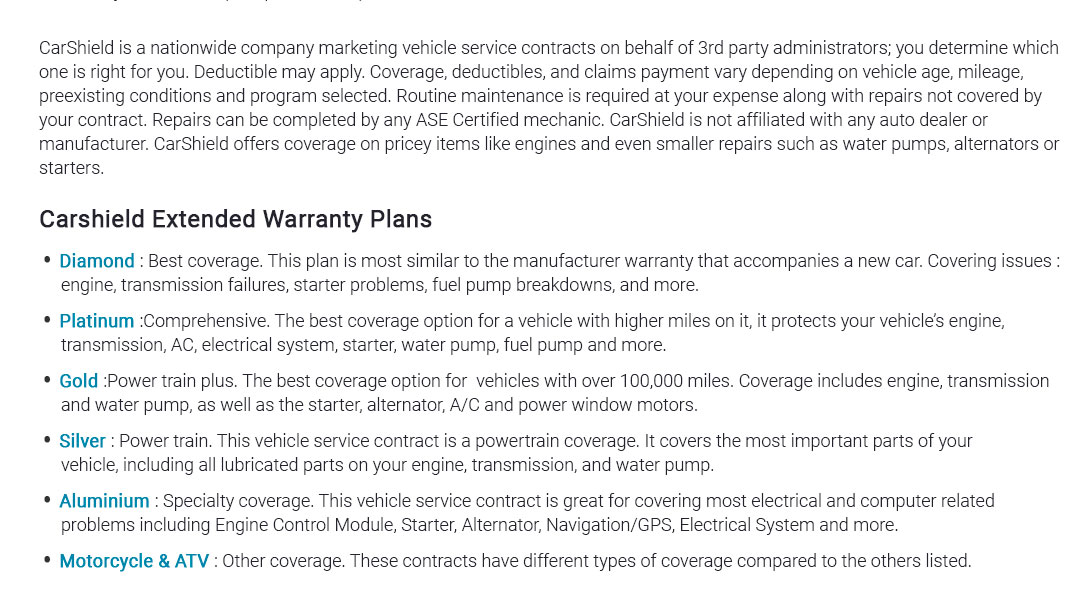

- Administrators/obligors: The entity that approves claims and pays the repair shop. Their rules govern your real experience.

- Brokers or agents: Present multiple plans, sometimes helpful for price and features, but service quality depends on the underlying administrator.

- Dealership programs: Convenient at purchase; stronger integration with OEM procedures, sometimes pricier, occasionally better OEM part alignment.

Coverage tiers compared- Powertrain: Engine, transmission, drivetrain. Cheaper; big failures covered, little stuff not.

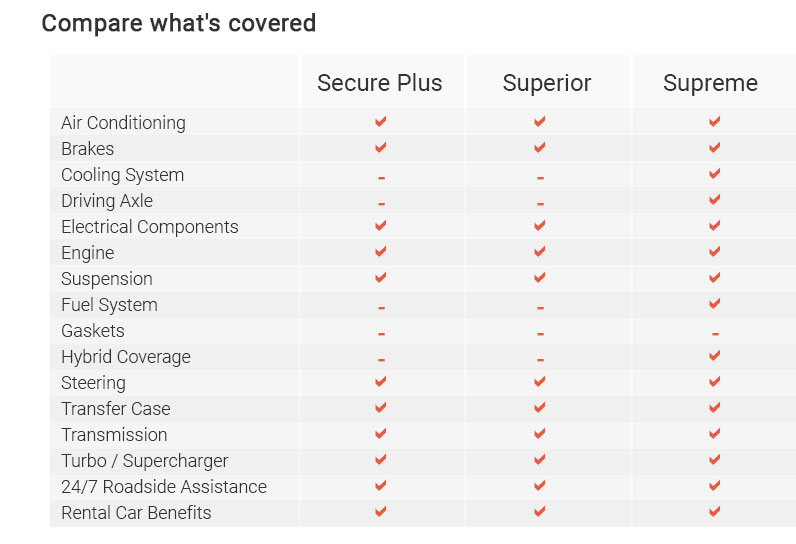

- Mid-tier (stated-component): A list of covered parts: air conditioning, steering, suspension, fuel system, many electronics. Read the list carefully.

- Exclusionary (premium): Covers everything except named exclusions. Simpler to understand; often the best fit for newer vehicles with complex tech.

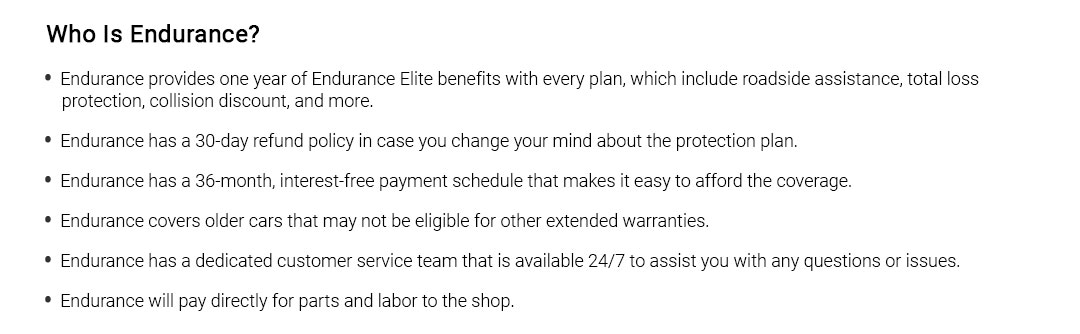

A quick real-world momentTuesday morning drizzle, an engine light, and a limp-mode crawl to an approved shop. The advisor calls the administrator, who asks for diagnostics, approves the water pump, and pays the shop directly. You cover a $100 deductible and head out by evening. The same event with a weaker company? Longer authorizations, parts downgrade debate, or a request that you front the repair and wait for reimbursement. Small differences in policy shape your day. Claims experience signals- Payment method: Direct pay to the shop beats reimbursements.

- Diagnostics: Do they cover tear-down and diagnostic time if the claim is approved?

- Parts rules: OEM vs reman vs aftermarket - who decides?

- Labor rates: Posted shop labor or a capped matrix? Regional flexibility matters.

- Network: Freedom to choose any ASE-certified shop can be worth more than a slightly lower premium.

- Claim hours: Weekday-only adjusters can strand weekend repairs.

Price, deductibles, and valueTotal cost typically spans four figures over multi-year terms. Think beyond sticker price: claim friction, component caps, and downtime shape value. Another angle: you're not just smoothing repair risk - you're buying a process for getting back on the road. - Deductible style: Per-visit is friendlier than per-component. A disappearing deductible (using specific shops) can help if those shops suit you.

- Waiting period/mileage: Prevents pre-existing claims; plan for the gap.

- Mileage/age surcharges: Higher for older, high-mileage, or luxury vehicles with costly electronics.

- Add-ons: Rental, roadside, trip interruption - handy if you travel, negligible if you don't.

Fine print that actually matters- Maintenance proof: Keep oil-change and fluid records. Missing receipts can sink claims.

- Pre-authorization: Unauthorized repairs risk denial, even if the part failed.

- Wear-and-tear vs sudden breakdown: Some contracts exclude gradual failure; others allow it after a certain mileage.

- Seals and gaskets: Included, limited, or excluded - read closely.

- Electronics and ADAS: Sensors, cameras, infotainment, and module programming may have caps or exclusions.

- Hybrid/EV items: Traction batteries and power electronics are often special riders with caps.

- Modified vehicles: Aftermarket tunes and lifts can void related coverage.

Who might benefit - and who probably won't- Good fit: Keeping the car 5 - 8 years; complex tech (turbo, air suspension, ADAS); long commutes where breakdowns cost time and income.

- Borderline: Low-mileage drivers with simple, cheap-to-fix cars; DIYers who handle most repairs.

- Poor fit: Short ownership cycles; robust OEM CPO remaining; drivers disciplined enough to self-fund a repair reserve.

How to compare in 7 minutes- Grab the sample contract PDF, not just the brochure.

- Scan exclusions, maintenance obligations, and claim steps.

- Check parts and labor caps; note if labor follows shop rates.

- Verify direct-pay and rental coverage details.

- Confirm shop choice freedom and roadside limits.

- Call support once: timing, tone, and specifics reveal culture.

- Ask for the administrator name; research their claim reputation, not just the salesperson.

Soft factors that separate companies- Transparency: Clear contract, no surprise fees, published sample plans.

- Authority: Frontline adjusters empowered to approve common repairs quickly.

- Flexibility: Reasonable diagnostics, OEM parts when warranted, fair labor matrices.

- Cancellation and transfer: Prorated refunds and easy ownership transfers add real value.

A small reframingWe often ask, "Will this cover a big repair?" Useful, yes. But a better lens is, "Does this company make approval predictable and painless?" You're not just choosing coverage; you're picking a claims culture. Bottom lineStrong extended auto warranty insurance companies pair clear contracts with fast, fair claims. Match coverage depth to your car's complexity, scrutinize the administrator behind the brochure, and value direct-pay, diagnostics, and labor fairness over minor price differences. The right fit feels calm on a stressful repair day - and that, more than brochure glitter, is the real return.

|

|